Taiwan standards and regulations

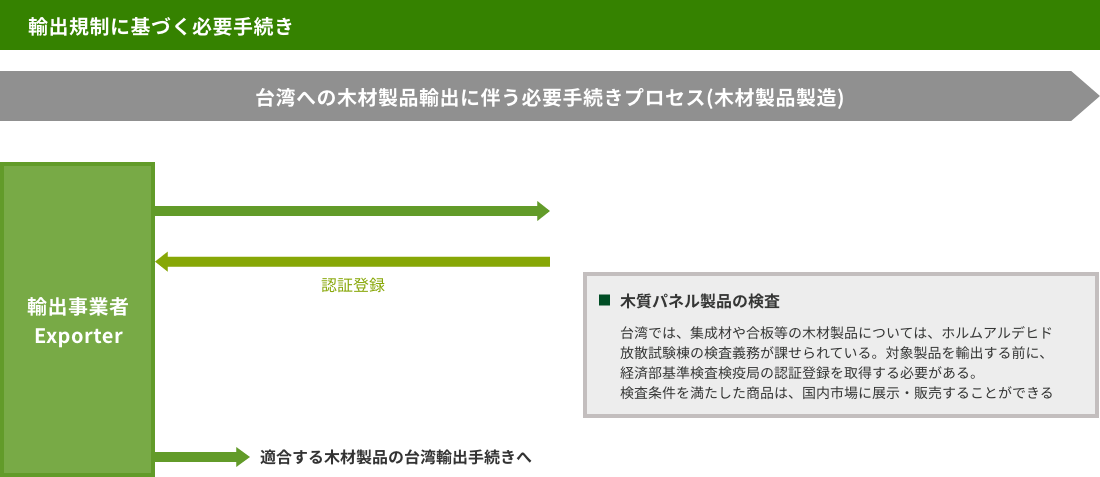

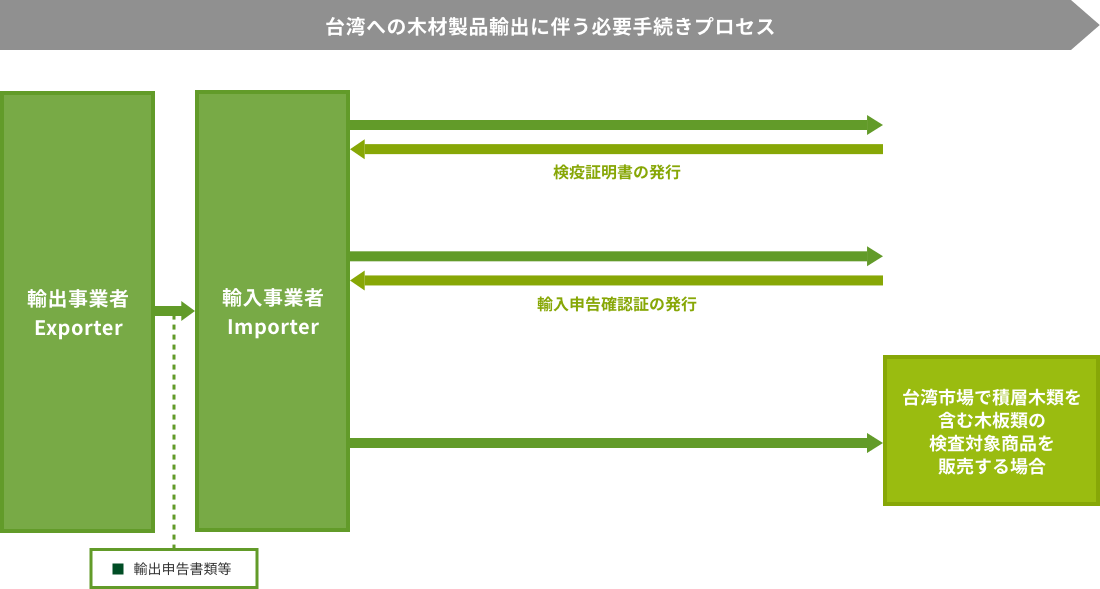

- Export procedure flow diagram

- Item definition

- Procedures required for export

- phytosanitary

- Import declaration

- Labeling

Quarantine information is also posted on the Ministry of Agriculture, Forestry and Fisheries website.

Please check this as well.

Export procedure flow diagram

Item definition

HS code for wood and its products and charcoal defined on this page

4407:

Wood (saw or split lengthwise, planed or peeled, with a thickness exceeding 6 millimeters, whether or not planed, sanded or vertically spliced) .)

4412:

Plywood, veneered panels and similar laminated wood

4413:

Improved wood, highly durable wood (limited to those in the form of blocks, plates, strips, or shapes)

Procedures required for import

1. Phytosanitary

Survey date: March 2023

Content

The Plant Quarantine and Epidemic Prevention Act requires importers to submit a phytosanitary certificate issued by the phytosanitary authority of the exporting country.

The related regulations, "Imported Wood Quarantine Conditions," require that when importing lumber such as sawn timber, plant quarantine must be carried out in the exporting country. After quarantine is implemented, a phytosanitary certificate issued by the phytosanitary authority of the exporting country must be attached and the product must be inspected by the phytosanitary authority.

In addition, wood from host species imported from countries and regions where the long-eared longhorn beetle is found is required to be heat-treated using a quarantine method specified by a plant quarantine agency prior to import, and this must be noted on the plant quarantine certificate.

In response to the outbreak of the long-eared longhorn beetle in Japan, phytosanitary conditions have been strengthened in Taiwan as of January 19, 2023. As a result, when importing wood into Taiwan, it is now necessary to attach a phytosanitary certificate, which was previously not required for wood without bark.

Related Links

2. Import declaration

Survey date: March 2023

Content

The Ministry of Finance Customs Office specifies the following documents as required at the time of import.

- import declaration form

- import permit

- Invoice

- packing list

- Bill of lading or air waybill

- phytosanitary certificate

- Power of attorney to forwarder

- certificate of origin

- Product catalogs, manuals, etc.

Related Links

3. Label display

Survey date: March 2023

Target items

Of 4412, "Plywood: ordinary plywood, special plywood, structural plywood, concrete formwork plywood, etc."

Other products include laminated wood (laminated veneer, structural laminated wood, etc.), flooring, medium density fiberboard, particle board, etc. However, raw materials for processing or assembling furniture are excluded.

Content

For laminated timber such as laminated wood and plywood, preliminary inspection procedures must be carried out before import. Products that meet the inspection conditions can be displayed and sold in the domestic market.

(For inspection procedures, please refer to "4. Inspection of wood panel products.")

The "Regulations Regarding Inspection of Wood Panel Products" requires the following information to be displayed on the product packaging or product itself.

- Product inspection stamp: Design, character string (“T” or “R”), and designation code printed due to inspection obligation

- Formaldehyde emission amount (F1 or F2 or F3)

- Manufacturer (or importer) name, address, or trademark

- Manufacturing date or batch number

- Name and place of origin

Related Links

Timber-related regulations

1. Inspection of wood panel products

Survey date: March 2023

Target items

Of 4412, "Plywood: ordinary plywood, special plywood, structural plywood, concrete formwork plywood, etc."

Other products include laminated wood (laminated veneer, structural laminated wood, etc.), flooring, medium density fiberboard, particle board, etc. However, raw materials for processing or assembling furniture are excluded.

Content

The "Regulations on Inspection of Wood Panel Products" requires prior inspection (product type approval test and product certification registration test) when importing laminated wood, plywood, etc. The following documents must be submitted to the Standards and Inspection Bureau of the Ministry of Economic Affairs or its competent branch office, and only products that have passed the inspection are allowed to be imported.

Product format approval test

Documents required to be submitted

- "Product format approval application form"

- Standard list

- A color photo of the finished product that is 4 x 6 inches or larger.

- Manufacturing process overview

- Chinese label sample

- product sample

*For product sample testing, the following samples are required.

Plywood: Cut at least two sets of products subject to formaldehyde emission testing using the following method.

- Plywood for concrete formwork: Each sheet is cut into 2 sets of 150 mm long x 50 mm wide x 10 sheets.

- Plywood other than concrete formwork: Cut into 2 sets each with a length of 150 mm x width of 50 mm, and a combined cross-section and bottom area of 1,800 square centimeters or more.

Laminated wood: At least two sets of products subject to formaldehyde emission testing, at least 5 cm from the edge, with a surface area of 450 square centimeters

Product certification registration

After applying for product type approval and obtaining the report, you can receive a product certification registration certificate by submitting the "Product Certification Registration Application Form" to the inspection agency.

Related Links

2. Lumber standards (CNS standards)

Survey date: March 2023

Target items

4407 wood

Content

There are standards and quality standards for the following products.

- Sawmill grade (CNS 444)

- Coniferous structural sawn timber (CNS 14630)

- Coniferous Interior Lumber Grade (CNS 15563)

- Hardwood sawn grade (CNS 15581)

- Grade of lumber for softwood substrate (CNS 15582)

- Sawn timber for framed wall construction method (CNS 14631)

Related Links

3. Plywood standards (CNS standards)

Survey date: March 2023

Target items

4412 plywood

Content

There are standards and quality standards for the following products.

- Ordinary plywood (CNS 1349)

- Special plywood (CNS 8058)

- Plywood for concrete formwork (CNS 8057)

- Flameproof plywood (CNS 11668)

- Flame-resistant plywood (CNS 11669)

- Architectural plywood (CNS 11670)

- Structural plywood (CNS 11671)

- Plywood for transportation pad (CNS 15583)

- Natural wood-based veneer structural plywood (CNS 15882)

Related Links

4. Technical specifications for the design and construction of wooden buildings

Survey date: March 2023

Target items

Structural lumber, structural laminated timber, structural plywood

Content

The types of structural timber (including sawn lumber, laminated timber, structural boards, structural assembly timber, etc.), sawn timber products, timber scale, material standards, material control, material protection, group labeling, performance certification, etc. are provided by CNS. Standards and "Technical Specifications for Design and Construction of Wooden Buildings" must be followed.

For structural timber, structural laminated timber, and structural plywood, indicators such as allowable stress and elastic modulus have been established.

Related Links

5. Green building material mark

Survey date: March 2023

Target items

Wooden building materials (structural laminated timber, structural plywood, coniferous structural sawn timber, framed wall construction method structural sawn timber, framed wall construction method vertical joint material, structural veneer laminated materials, structural wood boards, orthogonal laminated boards (CLT) )Such)

Content

Green building materials must meet the requirements stipulated by the "General Rules for Green Building Materials" (such as ensuring that they do not cause environmental pollution during the acquisition of raw materials, production, manufacturing, transportation and use of finished products, and that they do not cause any danger to the human body or the environment. This refers to products that have been certified and comply with regulations (e.g., meeting restrictions on the content of hazardous substances).

Green building materials are categorized into four categories: "ecology," "health," "regeneration," and "high performance (permeable pavement, soundproofing, energy saving)."

Wood products such as structural materials and plywood can be applied as "ecological green building materials."

It is recommended that a certain amount or more of green building materials be used in buildings certified under the "Green Building Mark" system, which has the same purpose.

For information on the certification process, please refer to the related link "2020 Green Building Materials Interpretation and Evaluation Manual".

Related Links

6. Green building mark

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

Green buildings are based on nine evaluation indicators (greening amount index, basic water conservation index, water resources index, daily energy conservation index, carbon dioxide reduction index, drainage improvement index, waste reduction index, biodiversity index) for buildings in Taiwan. This is a system that evaluates and certifies buildings that meet certain standards with respect to indoor environmental indicators.

In the Explanation and Evaluation Manual for Green Building Materials, it is stated that ``Based on the above norms (Article 323 of the Architectural Technology Regulations - Architectural Design and Construction Edition), new buildings, constructed, or maintained buildings for public use are eligible for green building materials. From 2021, the usage rate of indoor spaces must reach at least 60% of the total indoor surface area and 20% of the outdoor floor area. From this, it is thought that products that have obtained certification as green building materials will be preferentially adopted in green buildings.

Related Links

Import duties etc.

1. Customs duties

Survey date: March 2023

Content

Tariff rates for imports are set in three columns, and the tax rate in Column I is applied to goods imported from Japan.

Related Links You can search for tariff rates for each HS code by referring to the Customs Tariff Database, Ministry of Finance, Customs Bureau.

According to the "Customs Tariff Database," most of the goods classified in HS Codes 4407 and 4413 have tariffs set at 0%, while many goods classified in HS Code 4412 have tariffs of 8.5%-12%. Customs duty will be charged.