Vietnam standards and regulations

Quarantine information is also posted on the Ministry of Agriculture, Forestry and Fisheries website.

Please check this as well.

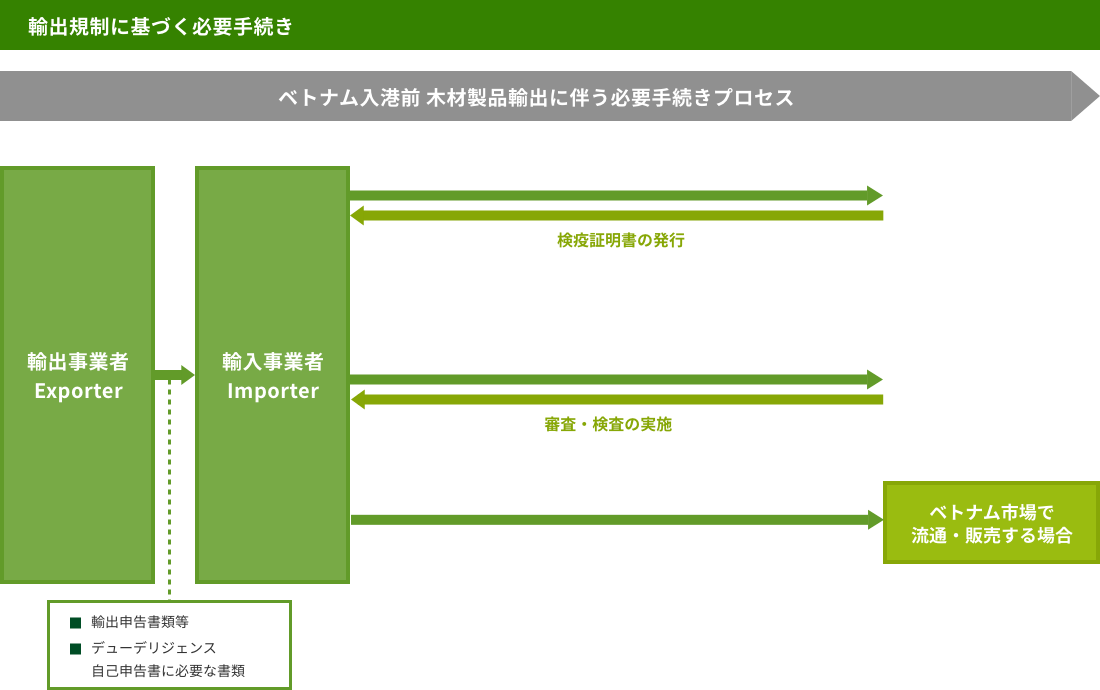

Export procedure flow diagram

Item definition

HS code for wood and its products and charcoal defined on this page

4407:

Wood (saw or split lengthwise, planed or peeled, with a thickness exceeding 6 millimeters, whether or not planed, sanded or vertically spliced) .)

4412:

Plywood, veneered panels and similar laminated wood

4413:

Improved wood, highly durable wood (limited to those in the form of blocks, plates, strips, or shapes)

Procedures required for import

1. Phytosanitary

Survey date: March 2023

Target items

4407 wood

Content

The Plant Protection and Quarantine Act requires that when importing wood products, plant quarantine be conducted in the exporting country and a quarantine certificate be attached. Additionally, when importing into Vietnam, documents and visual inspections are conducted, and if there is any doubt, 20% of the total amount is picked up and inspected. If pests are found, fumigation will be carried out on the Vietnamese side and the exporter will be charged an inspection fee.

The list of items subject to quarantine clearly states that wood-related products include logs, sawn timber, and sawdust.

4412 plywood and 4413 improved wood are not subject to plant quarantine.

Related Links

2. Approval of legality during import using VNTLAS

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

The timber exported and imported by Vietnam is based on the legal basis of “Regulations on Timber Legality Guarantee System in Vietnam (102/2020/ND-CP)” and “Ministry of Agriculture and Rural Development Circular (27/2018/TT-BNNPTNT)”. The Viet Nam Timber Legality Assurance System (VNTLAS) has been established as a means to confirm the legality of timber. VNTLAS has set up several verification steps, and by going through these steps when importing wood, you can confirm the legality.

Although there are plans to build VNTLAS as a web-based system, this has not yet materialized. For this reason, it is necessary to follow the necessary procedures for legality confirmation provided in "Decree No. 102/2020".

Please check the " Due Diligence " section for details on the required procedures.

Related Links

3. Import declaration

Survey date: March 2023

Content

When importing into Vietnam, the following documents are required for import declaration.

- Customs declaration form for imported goods

- Invoice (commercial invoice)

- Sales contract or equivalent document

- Import license for goods that require an import license

- bill of lading

- packing list

- certificate of origin

- Registration certificate for quality inspection issued by the inspection agency (phytosanitary certificate in the case of wood)

- Other documents related to products based on law (in the case of wood, due diligence self-declaration form compatible with VNTLAS)

Related Links

4. Due diligence

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

The “Regulations on Timber Legality Assurance System in Vietnam (102/2020/ND-CP)” stipulates that due diligence must be conducted on timber imported into Vietnam. Due diligence will be carried out by the importer completing the Declaration of Origin of Imported Timber (Form No. 03 in Annex I), which is one of the required documents for customs declaration.

Regarding the declaration of origin of imported wood, the following items A to D are stipulated in the following.

Japan is considered a low-risk country, so you only need to submit documents by checking A and B1, and additional documents such as proof of legality are not required.

Timber origin declaration requirements

A. General information regarding the imported cargo must be submitted: import or export timber owner's name and address, description of the product, HS code, scientific name, common name of the species, quantity, bill of lading number, invoice, Timber packing list, exporting country, logging country, etc.

B. Must declare the risk level of imported wood: Check the appropriate box below depending on the delivery situation.

B1. Non-risk species and timber from active geographical areas declared in sections C,D below. No additional documentation is required.

B2. Risk wood or timber from negative geographic areas requires additional documentation and declarations under Sections C and D below.

C. Additional documentation must be submitted if necessary: if the wood is a risk species or imported from a non-positive area

For wood materials: Timber owners must submit one of the following documents regarding the legal origin of logging:

- Voluntary certificate or national certificate of the exporting country recognized by Vietnam as meeting VNTLAS standards

- License or document proving permission to harvest timber

- If the logging country does not provide for a logging permit for the forest from which the timber is harvested, request additional documentation and ask for reasons why it does not provide for a permit.

- If felling documents are not available, additional information and reasons for not having felling documents are required.

For composite timber: The timber owner must provide one of the following documentation regarding the origin of the legal harvest:

- Voluntary certificate or national certificate of the exporting country recognized by Vietnam as meeting VNTLAS standards

- In the absence of a logging permit or documentation, additional documentation is required to verify the legality of the timber as permitted by the regulations of the country of harvest.

D. Additional measures must be taken by the importer to mitigate risks related to the legality of the timber, in accordance with the relevant laws and regulations of the logging country.

Information on legal provisions for timber exports in logging countries: Identify legal requirements, such as export prohibitions, export licensing requirements, that apply to timber exports by product or tree species in logging countries.

Risk Identification and Mitigation: Identify illegal logging and trade risks associated with shipments and proposed mitigation measures based on the relevant laws and regulations of the logging country.

Related Links

5. Labeling obligation

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

The "Decree on Amending Decree No. 43 on Product Labels (111/2021/ND-CP)" stipulates that for products imported into Vietnam, customs clearance personnel must affix an English label containing the following content: .

- Product name

- Product origin *1

- Organizations/individuals responsible for products in foreign countries or organizations/individuals producing products *2

*1 If the country of origin of a product cannot be determined, it is permitted to state the place of final processing of the product.

*2 If the label does not contain a description of "the organization/individual responsible for the product or the organization/individual producing the product in a foreign country," the import customs application form must include information regarding the organization/individual. Masu.

Related Links

Timber-related regulations

1. Vietnam National Standard (TCVN)

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

The Law on Standards and Technical Standards (No.68/2006/QH11) stipulates that Vietnam's national standards (TCVN, Vietnam Tiêu chuẩn Việt Nam) be developed and published. Although TCVN issued by the Vietnam Quality Standards Institute (VSQI) is a voluntary standard, it may become a mandatory standard if cited in legislation.

The Vietnam General Authority for Standards, Metrology and Quality (STAMEQ), which is a superior organization of the Vietnam Quality Standards Institute (VSQI), has four product certification bodies (QUATEST1, QUATEST2, QUATEST3, and QUACERT (Vietnam Certification Center)). The agency certifies TCVN.

There are various standards and quality standards for sawn lumber, plywood, highly durable wood, etc. These standards can be purchased within Vietnam.

- Basic principles for mechanical strength classes of structural materials (TCVN 8165:2009)

- About the adhesive quality of plywood - Part 1: Test method (TCVN 8328-1:2010)

- Regarding the durability of wood and wood products (solid wood treated with preservatives and insect repellents) - Part 1: Classification regarding penetration and retention of preservatives (TCVN 11346-1:2016)

Related Links

2. Building standards

Survey date: March 2023

Content

There are multiple laws governing building standards in Vietnam, including one that stipulates TCVN standards for building materials. However, there are no regulations regarding wood-related TCVN, and no standards that clearly stipulate requirements for wooden buildings have been found in Vietnam at present.

No. 681/QD BXD Structural Safety Assessment Process for Residential and Public Works

- In order to ensure the quality and safety of construction work, evaluation standards and evaluation processes regarding building structures have been established.

- TCVN standards include "stone brick structures," "concrete structures," "steel structures," "metal materials," "steel and steel products," and "construction mortar," but there are no standards for wood-related TCVN. .

No. 06/2021/ ND CP Quality Control and Construction Details

- It stipulates the quality and safety of construction work, but there is no mention of TCVN standards.

No. 50/2014/QH13 Building Law

- It stipulates urban planning, construction plans, construction designs, building permits, etc., but there is no mention of TCVN standards.

Related Links

Import duties etc.

1. Customs duties

Survey date: March 2023

Target items

4407 wood, 4412 plywood, 4413 improved wood (high durability wood)

Content

Based on the Customs Law (54/2014/QH13), customs duties are levied when goods are imported into Vietnam.

Trade between Japan and Vietnam is covered by the Japan-ASEAN Comprehensive Economic Partnership Agreement (AJCEP) (effective December 2008) and the Japan-Vietnam Economic Partnership Agreement (VJEPA) (effective October 2009). It has become. These agreements provide for gradual reductions in tariffs.

Please refer to the "Cabinet Order (160/2017/ND-CP)" for details on tariff rates based on AJCEP, and the "Cabinet Decree (155/2017/ND-CP)" for details on tariff rates based on VJEPA.

By accessing the tariff rate database of the Vietnam General Department of Customs, you can search the tariff rate for each HS code. According to the database, the following tariff rates will be charged when importing goods with HS code 4407,4412.

Main tariff rates by HS code

- 4407: 0%

- 4412: 0%

- 4413: No data registered